Capital Allowance for Motor Vehicle

Publications for Motor Vehicles. For each month during which the employee is entitled to use the vehicle for private purposes the value is 35 of the determined value of the motor vehicle.

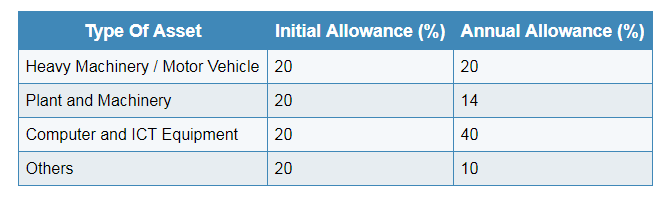

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Capital Allowance of Motor Vehicle.

. An equity or loan interest is issued at a discount as provided. Car means a motor vehicle except a motor cycle or similar vehicle. This is because paragraph 181b prohibits the deduction of any outlay loss or replacement of capital payment on account of capital or any allowance for depreciation obsolescence or depletion unless specifically allowed in Part I of.

Is essentially a motor vehicle for use on streets. Line 22900 was line 229 before tax year 2019. Drivers Licence - Frequently Asked Questions.

Capital Allowance Claim for Motor Vehicles. Eligible interest you paid on a loan used to buy the motor vehicle. Reasonable food and drink amounts for employees living away from home.

Disallowed capital allowance percentage has the meaning given by subsection 250-1504. The capital cost limits on a Class 101 vehicle a passenger vehicle still apply when you split the capital cost between business and personal use. Paid on a cents per.

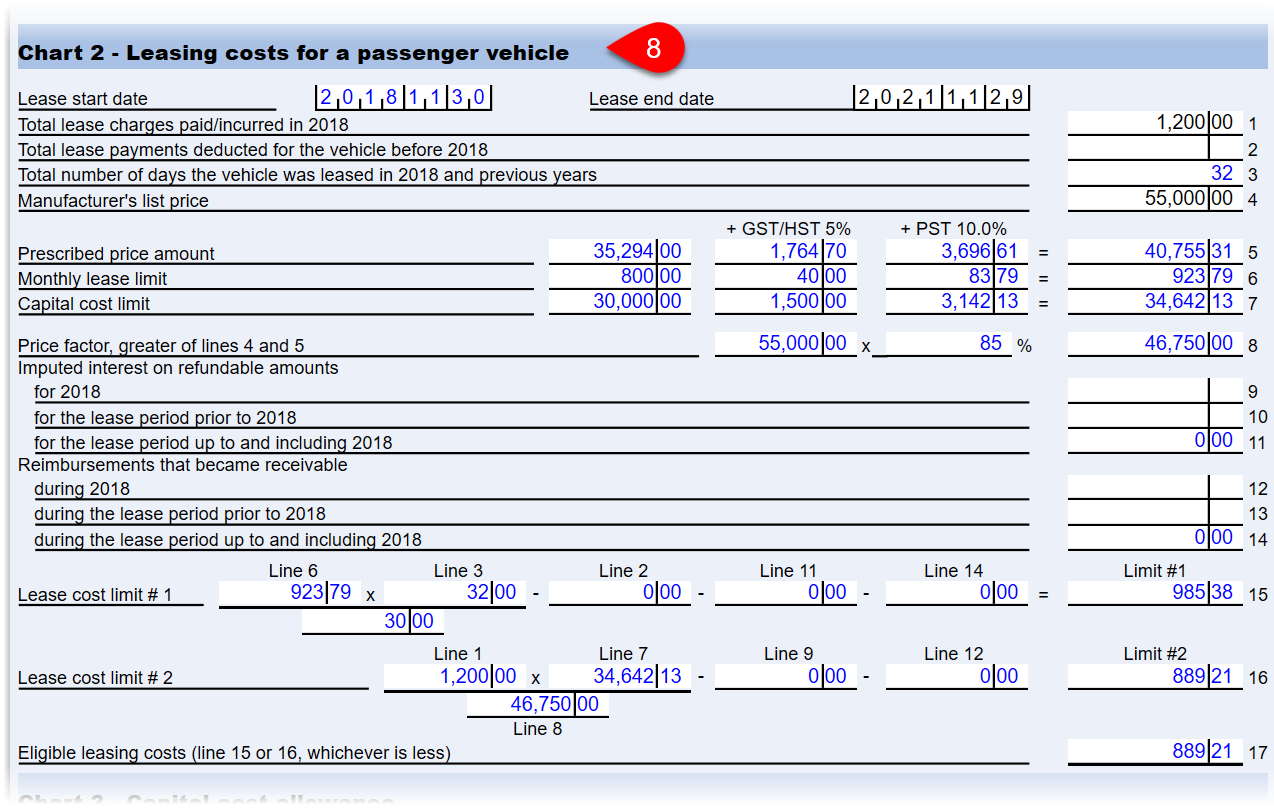

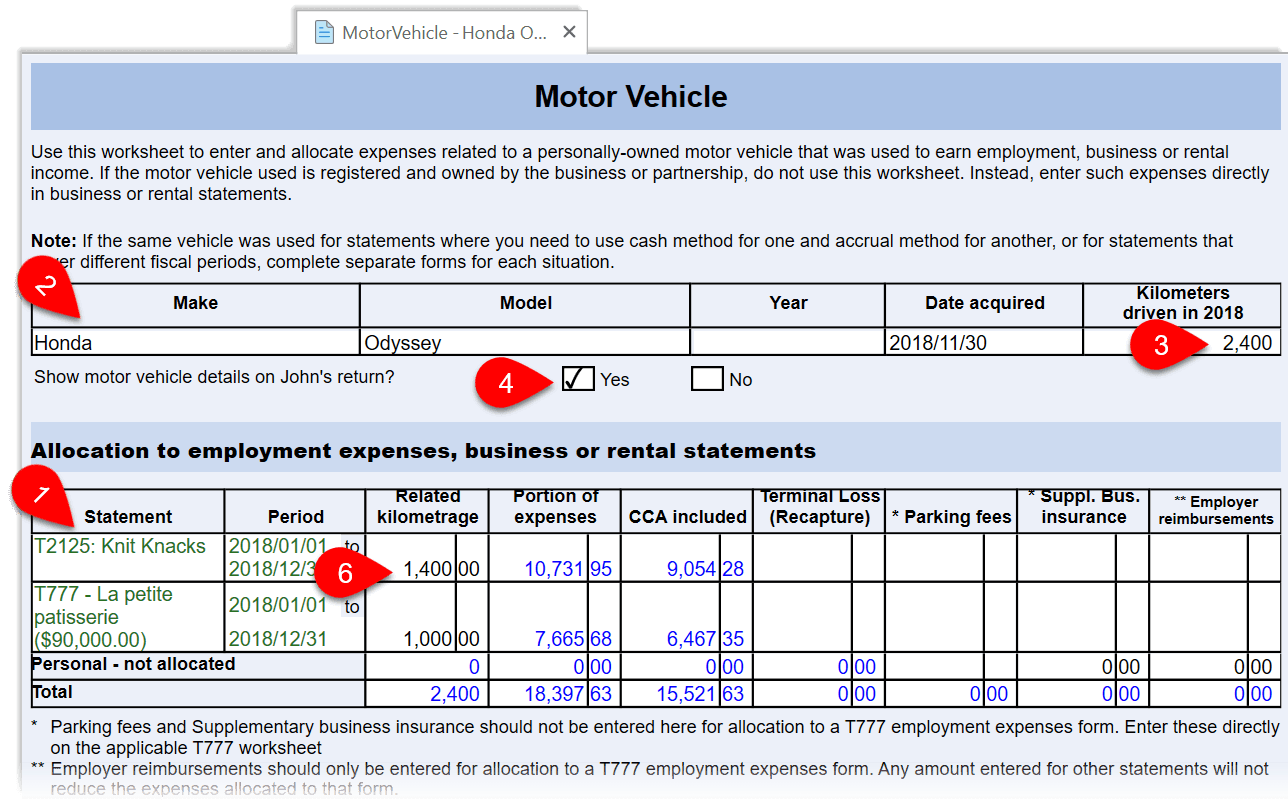

Motor vehicle allowance paid on a per kilometre basis Section 22 of the Fringe Benefits Tax Assessment Act 1986 the FBT Act generally exempts an expense payment benefit if it is a reimbursement of car expenses of a car owned or leased by an employee that is calculated by reference to the distance travelled by the car ie. We define motor vehicle passenger vehicle and zero-emission vehicles in Type of vehicle. For more information on capital expenditures see Income Tax Folio S3-F4-C1 General Discussion of Capital Cost Allowance.

For more information see the section Motor vehicle expenses in Guide T4002 Self-employed Business Professional Commission. To calculate CCA list all the additional depreciable. S-plated cars and business cars eg.

Q A - Motor Vehicle Faded Plates. The capital allowance regime provides traders with relief for the cost of buying cars and vans that are used within the business enabling a deduction of up to 130 of the cost against business profits. The depreciation allowance can only be granted for each completed period of 12 months.

A motor vehicle is either a car or an other vehicle. Employees Withholding Allowance and Status Certificate. The rate for Initial Allowance and Annual Allowance is 20 respectively.

Motor Vehicle Drivers Licence Fees - brochure. However you may be able to claim capital cost allowance on repaired property. Q A - Motor Vehicle Transactions.

Muhammad purchased a new vehicle for 70000 to transport goods for his business. Work out earlier record keeping rates and exemption thresholds. Many four-wheel drives and some.

Car A car is a motor vehicle that is designed to carry. Learn how to calculate capital cost allowance CCA for your Canadian business income and to fill out your tax return with this guide to the CCA schedule. Information for individuals and partners claiming capital cost allowance on the depreciable property used in their businesses and the criteria for each class.

Employees Statement to Employer Concerning Non-Residence in the State of Hawaii. A vehicle of a construction. Nevertheless starting from year of assessment 2001 the limitation amount for qualifying plant expenditure for motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers which is.

Claiming CCA for a work space in the home can have a negative effect for purposes of the principal residence exemption. If you use a motor vehicle or passenger vehicle for business and personal use you can deduct only the part of the expenses you paid to earn income. 2004 but before 2005 and you made an election.

Q-plated and RU-plated cars. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. A motor vehicle allowance can be paid on the basis of an amount per business kilometre travelled by the employee or as a regular flat or fixed amount.

Motor vehicle other than a car cents per kilometre rate. For your motor vehicle. Motor Vehicle Use Tax Certification Affidavit in Support of a Claim for Exemption from Use Tax for a Motor Vehicle Transferred as a Gift Attach to Form G-27.

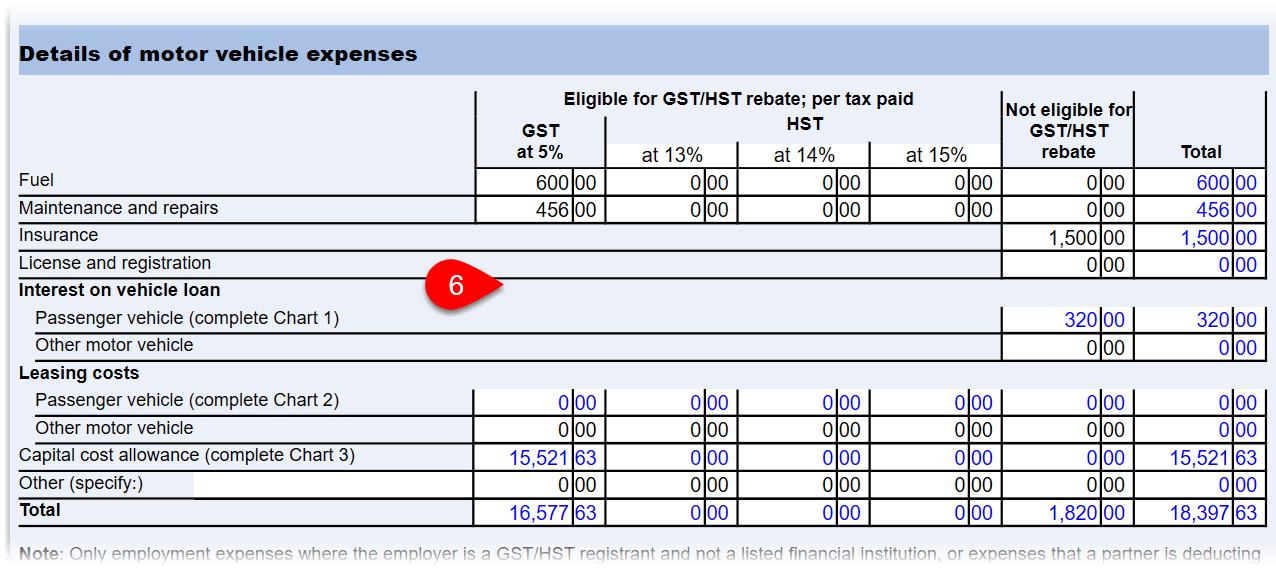

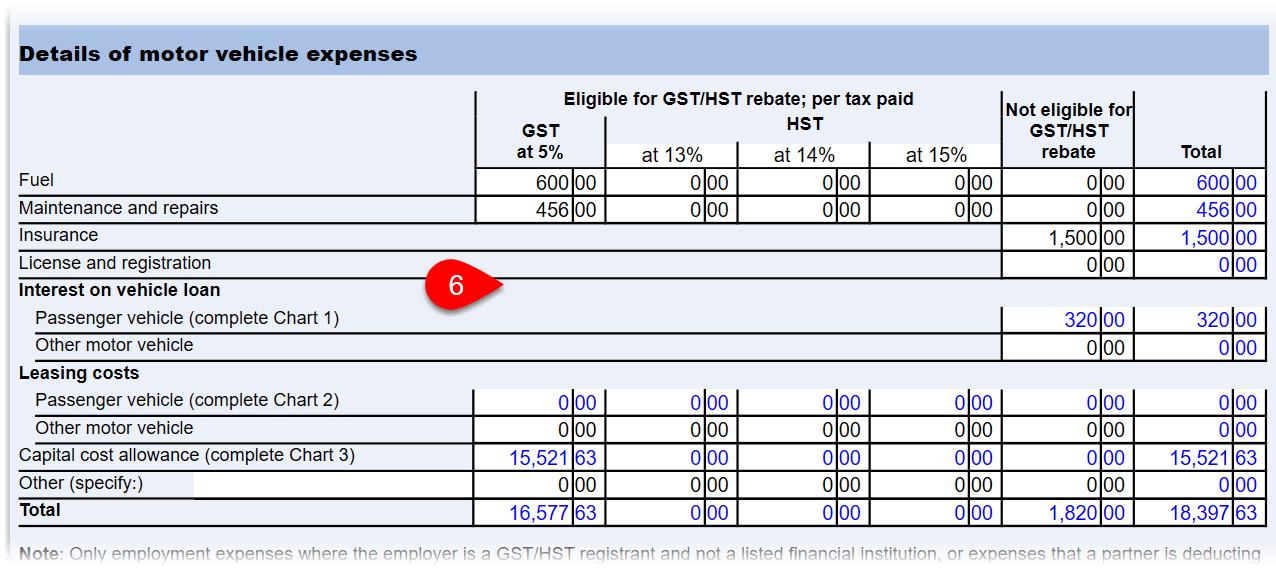

Information on motor vehicle expenses you can deduct as a salaried employee if you meet certain conditions. Line 22900 was line 229 before tax year 2019. Motor vehicles including some passenger vehicles can be included in this class.

If the motor vehicle qualifies for capital allowances the expenditure incurred on obtaining the COE may be included when claiming capital allowances on the. Capital allowances cannot be claimed on the costs of private cars eg. Class 101 30 If you own a second vehicle that was purchased.

Pay by instalments threshold. Any vehicle not classed as a motor vehicle The Canada Revenue Agency provides a chart of vehicle definitions for vehicles bought or leased after June 17 1987 and used to earn business income. Effective 1 March 2011 the percentage rate for all employer-provided vehicles.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Information on the various classes of depreciable property that qualify for a capital cost allowance deduction. You cannot deduct costs you incur for capital repairs.

For more information see Class 101 30. Note that goods and services tax GST and provincial sales tax PST or harmonized sales tax HST should not be included when calculating the cost. For more information about capital cost allowance see Guide T4002.

11 A taxpayer cannot deduct the cost of a capital expenditure in computing income from a business or property. Drivers - Lost Documents. However you can deduct the full amount of parking fees related to.

Types of motor vehicles The type of motor vehicle you drive can affect how you calculate your claim. The exempt rate for overnight accommodation allowances is the total reasonable amount for daily travel allowance expense using the lowest capital city for the lowest salary band for the. Capital allowance is only applicable to business activity and not for individual.

Get 247 customer support help when you place a homework help service order with us. Value to be placed on the benefit. A load of less than one tonne and fewer than 9 passengers.

All other rates and thresholds will only be available here. Find out more about FBT for employers. Capital Cost Allowance CCA is a set of rates stating the amount you can claim each year on a depreciable property used for business activities.

Motor vehicle will be classified into 2 categories-Commercial car such as van lorry and bus. Motor Vehicle Modificatio ns. The maximum capital cost of each vehicle that may be included in Class 101 is now 30000 plus GST and provincial sales tax.

When you look at Area ASchedule 8 you will see a table with eight different columns and a separate chart for Motor vehicle CCA. Purchase of a motor vehicle with a capacity of more than one tonne but less than 9 passengers the effect of the car limit for depreciation. Effective life - rulings law and objections.

The vehicle is used 100 for business. For capital allowances purposes a car is a mechanically propelled road vehicle that is not.

Motor Vehicle Expenses Taxcycle

Motor Vehicle Expenses Taxcycle

Motor Vehicle Expenses Taxcycle

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

0 Response to "Capital Allowance for Motor Vehicle"

Post a Comment